Dépêches

In-Building Wireless Deployment Revenue to Approach $10 Billion in 2012, Says ABI Research

Dépèche transmise le 3 mai 2011 par Business Wire

In-Building Wireless Deployment Revenue to Approach $10 Billion in 2012, Says ABI Research

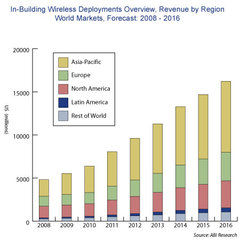

NEW YORK--(BUSINESS WIRE)--In-Building Wireless (IBW) systems are showing solid adoption rates and according to the latest forecasts from ABI Research should register almost $10 billion worth of deployments next year.

Corporate campuses, airports and railway stations, and retail shopping centers (in that order) are the leading verticals where the need for good indoor cellular coverage and throughput is driving the IBW market. Healthcare facilities follow close behind.

According to industry analyst Xavier Ortiz, “The primary drivers for IBW markets are the constantly-growing amount of data traffic, the rapid uptake of smartphones and other data-oriented devices, and consumers’ heightened service expectations. Many organizations now appreciate the added value IBW systems can bring, and the economic recovery now under way in many regions has meant the resumption of deployments that were shelved during the worst of the slump.”

The question “who’s buying?” may have different answers from building to building, depending on who has most to gain: enterprises, building owners, transport authorities, mobile operators, or others. There’s also a role for managed service providers.

The majority of deployments will continue to be found in the Asia-Pacific region, with its high population density and mobile penetration. Europe and North America show consistent but much lower levels of activity with roughly equal deployment numbers in each region.

However, notes practice director Aditya Kaul, “While the Asia-Pacific region accounts for the majority of IBW deployments, most innovation is coming from North America where many of the largest vendors are based and where budgets can support the often considerable expense of IBW. A little later these innovations filter through to Europe, and then to Asia, where cost-effective solutions are in greatest demand.”

While the three largest IBW vendors (TE Connectivity, Andrew and Corning/Mobile Access) command almost 60% of this complex ecosystem worldwide, it is by innovating, say the analysts, that the smaller players can build a track record and boost their reputations.

ABI Research’s “In-building Wireless Systems” study (http://www.abiresearch.com/research/1003278) covers DAS (Distributed Antenna Systems both active and passive), repeaters, and the role currently played by picocells and femtocells in IBW. It includes a detailed breakdown of revenue, deployments, and shipments by region, system type, vertical type and building size.

The report is part of the firm’s Femtocell and Small Cell Research Service (http://www.abiresearch.com/products/service/Femtocells_Research_Service).

ABI Research provides in-depth analysis and quantitative forecasting of trends in global connectivity and other emerging technologies. From offices in North America, Europe and Asia, ABI Research’s worldwide team of experts advises thousands of decision makers through 30+ research and advisory services. Est. 1990. For more information visit www.abiresearch.com, or call +1.516.624.2500.

Photos/Multimedia Gallery Available: http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6707517&lang=en

- 22/04 Finnair a dévoilé son programme de vol pour les saisons hiver 2024 et été 2025

- 22/04 Qatar Airways annonce le lancement de vols à destination de Kinshasa

- 22/04 Vietnam Airlines et CAE prolongent leur accord

- 22/04 Mermoz Academy de Tours commande des Tecnam P-Mentor

- 22/04 Transavia France reçoit son 2e Airbus A320neo

- 20/04 Friedrichshafen 2024 : Blackwing présente un nouveau modèle de son BW650RG

- 20/04 Friedrichshafen 2024 : JMB Aircraft présente son Phoenix

- 19/04 Friedrichshafen 2024 : le projet "Fly To The North"

- 19/04 Friedrichshafen 2024 : Aura Aero présente pour la première fois ses trois appareils

- 19/04 Friedrichshafen 2024 : Duc Hélices présente son hélice Tiger-3

- 19/04 Friedrichshafen 2024 : Splash-in Aviation expose son Pétrel X

- 19/04 Friedrichshafen 2024 : Robin "toujours présent et pour longtemps"

- 19/04 Friedrichshafen 2024 : Beringer présente au salon

- 19/04Friedrichshafen 2024 : la FFPLUM dément le passage de tous les ULM 3 axes à 600kg

- 19/04 Friedrichshafen 2024 : visite d'un Pilatus PC-12 (photos)

- 17/04 Friedrichshafen 2024 : Cirrus Aircraft présente son SR G7

- 17/04 Friedrichshafen 2024 : Piper présente son M700 Fury

- 17/04 Friedrichshafen 2024 : Junkers dévoile son A50 Heritage

- 17/04 Friedrichshafen 2024 : la société E-Props présente au salon

- 17/04 Le 30e salon de Friedrichshafen a ouvert ses portes