Dépêches

Philly Fed Firms See Slight Growth in Business Activity

Dépèche transmise le 19 mai 2011 par Business Wire

Philly Fed Firms See Slight Growth in Business Activity

PHILADELPHIA--(BUSINESS WIRE)--Responses to the Business Outlook Survey suggest that regional manufacturing activity grew slightly in May. Nearly all of the survey’s broadest indicators remained positive but fell from their readings in the previous month. The current employment index, however, showed resilience and improved this month. Indicators for prices fell back somewhat from their relatively high readings of recent months but still suggest considerable price pressure. The survey’s indicators of future activity fell sharply this month, reflecting consensus about future growth. Read the report.

Indicators Suggest Growth Has Slowed

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 18.5 in April to 3.9, its lowest reading since last October (see Chart). The demand for manufactured goods, as measured by the current new orders index, showed a similar slowing: The index fell 13 points while the shipments index declined 23 points; both remained positive, however, suggesting slight growth last month. For the first time in eight months, firms reported that unfilled orders and delivery times were falling—both indexes were slightly negative this month.

Firms’ responses continue to indicate overall improvement in the labor market despite weaker activity, orders, and shipments. The current employment index increased nearly 10 points and has now remained positive for eight consecutive months. The percentage of firms reporting an increase in employment (32 percent) is higher than the percentage reporting a decline (10 percent). Only slightly more firms reported a longer workweek (17 percent) than reported a shorter one (13 percent) and the workweek index decreased 14 points.

Price Pressures Moderate Slightly

Indexes for prices paid and prices received declined from April but remain at relatively high readings, suggesting that considerable price pressures remain. The prices paid index declined 9 points this month, but it is still at a relatively high reading of 48.3. Fifty-six percent of the firms reported higher prices for inputs this month, and 8 percent reported a decline. On balance, firms also reported a rise in prices for manufactured goods: 20 percent reported higher prices for their own goods this month; just 3 percent reported price reductions. The prices received index decreased nearly 11 points, its first decline in nine months.

Six-Month Indicators Fall Sharply

The future general activity index decreased 17 points this month, following a 29-point decline last month (see Chart). The indexes for future new orders and shipments also declined, decreasing 12 and 17 points, respectively. The index for future employment, which had been improving in recent months, fell back 15 points. Still, more firms expect to increase employment over the next six months (29 percent) than expect to decrease employment (7 percent).

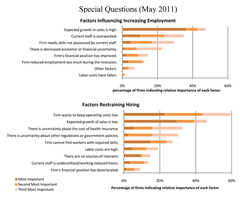

In special questions this month, firms were asked about the factors that are influencing their hiring plans (see Special Questions). Among the 48 percent of firms that are planning to increase employment over the next year, the most frequently cited reason influencing this decision was the expectation of high sales growth. The second and third most cited reasons were that current staff is overworked and the need to obtain skills not possessed by current staff. The most frequently cited factor for restraining hiring among all the firms was the need to keep costs low and low expectations of sales growth. Uncertainty about health-care costs, regulations, and government policies was also prominently listed.

Summary

According to respondents to the May Business Outlook Survey, the region’s manufacturing sector grew, but at a slower pace this month. Most of the survey’s broad indicators fell but continued to signal overall expansion. A majority of firms continued to cite input price pressures and a sizable share of firms reported higher prices for their own manufactured goods again this month. Indicators for future activity fell back sharply this month but continued to suggest that firms expect the current expansion in manufacturing to continue over the next six months.

|

BUSINESS OUTLOOK

|

May vs. April |

Six Months from Now vs. May |

||||||||||||||||||

|

Previous |

Increase |

No |

Decrease |

Diffusion |

Previous |

Increase |

No |

Decrease |

Diffusion |

|||||||||||

| What is your evaluation of the level of general business activity? |

18.5 |

25.0 | 52.2 | 21.1 | 3.9 | 33.6 | 35.8 | 41.7 | 19.2 | 16.6 | ||||||||||

|

Company Business Indicators |

||||||||||||||||||||

|

New Orders |

18.8 | 28.4 | 48.7 | 23.0 | 5.4 | 29.2 | 36.6 | 41.4 | 19.9 | 16.8 | ||||||||||

|

Shipments |

29.1 | 29.8 | 46.8 | 23.3 | 6.5 | 37.8 | 40.5 | 34.7 | 20.0 | 20.4 | ||||||||||

|

Unfilled Orders |

12.9 | 14.1 | 64.1 | 21.8 | -7.8 | 14.1 | 13.2 | 65.3 | 14.2 | -1.0 | ||||||||||

|

Delivery Times |

11.2 | 12.3 | 73.1 | 14.6 | -2.3 | -1.1 | 13.2 | 69.5 | 16.8 | -3.7 | ||||||||||

|

Inventories |

1.7 | 21.1 | 50.7 | 26.5 | -5.4 | 10.0 | 20.8 | 62.3 | 15.7 | 5.2 | ||||||||||

|

Prices Paid |

57.1 | 56.3 | 35.6 | 8.0 | 48.3 | 57.0 | 59.1 | 33.1 | 6.7 | 52.4 | ||||||||||

|

Prices Received |

27.5 | 19.7 | 76.2 | 2.9 | 16.8 | 37.5 | 34.9 | 53.2 | 7.6 | 27.3 | ||||||||||

|

Number of Employees |

12.3 | 32.2 | 57.6 | 10.2 | 22.1 | 37.7 | 28.9 | 62.6 | 6.6 | 22.3 | ||||||||||

|

Average Employee Workweek |

17.7 | 16.9 | 69.5 | 12.9 | 3.9 | 18.4 | 20.1 | 65.7 | 10.3 | 9.8 | ||||||||||

|

Capital Expenditures |

-- | -- | -- | -- | -- | 20.0 | 33.2 | 50.8 | 10.1 | 23.1 | ||||||||||

|

NOTES: |

||

| (1) | Items may not add up to 100 percent because of omission by respondents. | |

| (2) | All data are seasonally adjusted. | |

| (3) | Diffusion indexes represent the percentage indicating an increase minus the percentage indicating a decrease. | |

| (4) | Survey results reflect data received through May 17, 2011. | |

Photos/Multimedia Gallery Available: http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6729737&lang=en

- 15/04 Airbus : commandes et livraisons de mars 2024

- 15/04 easyJet renforce ses dessertes depuis la France vers Budapest

- 15/04 Vueling inaugure sa liaison entre Orly et Heathrow

- 12/04 British Airways ouvre les candidatures pour son programme cadets Speedbird Pilot Academy

- 12/04 Icelandair et Expedia annoncent un nouveau partenariat

- 12/04 Turkish Airlines : résultats 2023

- 12/04 easyJet annonce deux nouvelles lignes depuis Lyon

- 12/04 Le premier Embraer E190 P2F fait son vol inaugural

- 12/04 Volotea obtient l'agrément complet pour son Système de Management de la Sécurité

- 12/04 easyJet et l'UNICEF lancent la campagne "Every Child Can Fly"

- 12/04 Emirates fête ses 30 ans de présence à l'aéroport de Nice

- 12/04 Ryanair reprend ses opérations vers/depuis Israël

- 11/04 Euroairlines rejoint l'accord multilatéral de trafic interligne de l'IATA

- 11/04 United facilite la réservation de vols des passagers en fauteuil roulant

- 11/04 Elixir annonce l'ouverture d'une usine aux Etats-Unis

- 11/04 Elixir annonce l'ouverture d'une usine aux Etats-Unis

- 11/04 Air Tahiti signe un partage de code avec Air Rarotonga

- 11/04 easyJet a inauguré une nouvelle liaison depuis Montpellier

- 11/04 Korean Air présente ses nouveaux uniformes écoresponsables pour ses équipes de maintenance, d'aérospatiale et de fret

- 10/04 easyJet inaugure deux nouvelles liaisons depuis Lyon